[Joint Statement] Briefing to banks and potential investors on the ongoing risks and outstanding social conflicts in the palm oil agribusiness sector

Briefing to banks and potential investors on the ongoing risks and outstanding social conflicts in the palm oil agribusiness sector: Golden Agri-Resources (GAR) bond offering

============

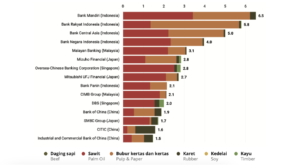

Credit Suisse, Oversea-Chinese Banking Corporation (OCBC) and Mitsubishi UFJ Securities are acting for Golden Agri-Resources – part of the Sinar Mas Group – in a new bond offering worth up to USD 400 million, according to a Debtwire report last week.[i] The syndicate has begun meetings with credit investors this week in Hong Kong and Singapore.

Banks and investors must examine the full range of environmental, social, reputational, legal and market risks prevalent in the palm oil sector and ensure that they undertake enhanced, robust due diligence procedures to identify, understand and screen these risks prior to any financing.

Effective bank policies and due diligence systems would ensure banks and investors avoid providing any financial support to companies that lack adequate palm oil policies or are involved in tropical deforestation, plantation expansion on carbon-rich tropical peatlands, failure to respect and uphold the rights of Indigenous peoples and communities to provide their free, prior and informed consent to activities impacting their customary lands, or on-going violations of human and labor rights.

A strong palm oil commitment is an important first step towards being a responsible company, but banks and investors should not assume that companies with strong palm oil commitments in place are free of environmental, social, reputational, legal and market risks.

GAR’s 2011 Forest Conservation Policy and recent sustainability efforts indicate GAR’s commitment to become a more responsible business. However, there remain some major issues in GAR’s policy implementation at this time. Banks and investors must ensure that GAR actively addresses these problems prior to providing financial services or investment.

The following grievances between GAR and communities in Indonesia and Liberia must be resolved to the satisfaction of the communities impacted as a matter of priority:

- This month the Round table on Sustainable Palm Oil (RSPO) found GAR to be in violation of its certification standards and procedures. This was the result of detailed field studies of GAR operations in West Kalimantan by the Forest Peoples Programme, TUK and LinkAR-Borneo.[ii] The complaint found that GAR failed to obtain the Free Prior and Informed Consent (FPIC) of local communities, failed to undertake proper assessments of High Conservation Value areas (HCV), and was in non-compliance with Indonesian laws in relation to plantation permits.

- A recent study by the Forest Peoples Programme into GAR’s palm oil operations with Golden Veroleum Liberia Inc. (GVL) shows major environmental and social concerns also exist in the group’s Liberia operations.[iii] The report cites numerous failures to adhere to key provisions in applicable law, RSPO standards and GAR’s own Forest Conservation Policy. The report states that the group’s social engagement is seriously flawed in both policy and practice, leading to vague, inadequate and potentially unenforceable promises of development benefits, while risking the permanent loss of, and damage to, community lands, natural resources, livelihoods and cultures. In particular, the report finds that the group’s business model being applied in Liberia is incompatible with the key legal, RSPO and Forest Conservation Policy tenet of free, prior and informed consent (FPIC), causing significant community division and conflict in the process. The study concluded that land has been and continues to be taken by the company without community’s FPIC.

- In November 2014, GAR confirmed that it was sourcing from companies operating within the Leuser Ecosystem, a global hotspot for biodiversity on the island of Sumatra, Indonesia. This area is the last place on Earth where critically endangered Sumatran orangutans, elephants, tigers, and rhinos are found together in the wild. Investigations by Rainforest Action Network have shown that GAR is at risk of sourcing from growers that have cleared and continue to clear High Conservation Value areas, High Carbon Stock forests and peatlands within the Leuser Ecosystem.[iv] GAR has not yet fully implemented its sustainability policies in order to exclude supplies of conflict palm oil from its supply chain.

GAR’s parent company – the Sinar Mas Group – has come under scrutiny following the brutal murder of Indra Pelani – a local Indonesian farmer and land rights activist killed by security guards contracted by Sinar Mas’s Asia Pulp and Paper. The company immediately condemned the killing and sacked the security personnel, but the incident points to the severity of risk associated with long-term conflict between Indonesia’s plantation sector and local communities.

Banks and potential investors committed to implementing responsible investment standards should require GAR to commit to:

- Halt operations in any areas of disputed land and implement new conflict resolution processes so that outstanding conflicts with communities can be resolved. This should include renegotiating with local communities so that Free Prior and Informed Consent is properly and fairly obtained.

- Uphold all its obligations under the RSPO including compliance with New Planting Procedures, robust FPIC processes, resolving complaints, undertaking credible HCV assessments and GHG emission audits, and comprehensive reporting.

- Strengthen its palm oil commitment to ensure that its policies and Standard Operating Procedures are consistent with the principles and implementation guidance for Free and Fair Labor in Palm Oil Production[v]

- Rapidly implement its commitments to eliminate third-party conflict palm oil suppliers from its downstream supply chains.

Forest Peoples Programme

Rainforest Action Network

TuK Indonesia

Bruno Manser Fund

Friends of the Earth US

Friends of Siberian Forests

Fern

Facing Finance

Urgewald

Banktrack

For further inquiries and interview requests, please contact:

Tom Picken, Senior Advisor for Forests and Finance campaign, Rainforest Action Network: [email protected]

James Harvey, Communications Manager, Forest Peoples Programme: [email protected]

Merel van der Mark, Banktrack Forest Campaigner: [email protected]

[i] http://asia.debtwire.com/intelligence/intelligencedetail.asp?style=34&id=1999630&verb=75&pPopup=1

[ii] http://www.forestpeoples.org/sites/fpp/files/publication/2014/01/pt-kpc-report-january-2014final.pdf

[iii]http://www.forestpeoples.org/sites/fpp/files/news/2015/04/Hollow%20Promises%20PRESS%20RELEASE.pdf

[iv] http://www.ran.org/lastplaceonearth

[v] http://www.humanityunited.org/wp-content/uploads/2015/03/Palm_Oil_Principles_030315.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!